In this installment of our “Business Intel” series — helping you monitor, understand and maximize your organization’s liquidity and cash management processes — we offer insights into the technical and reporting differences between net revenue, gross profit and net income.

As we’ve learned throughout this series, managing cash flows takes many considerations, and the best way for an organization to withstand an economic crisis is to have reliable sources of working capital.

Leading a successful business requires comprehensive analysis of operations, sales and financial results. There are hundreds of different key performance indicators (KPIs), but the idea is to nail down the metrics that are most useful to your organization and its goals. The revenue metrics we will discuss this week will provide results that show if the market is interested in your product or service, if your marketing efforts are paying off, whether sales are growing, how efficiently you are using your resources and more. It all starts with examining the key differences between net revenue, gross profit and net income.

Net Revenue

Net revenue — income earned from normal business activities, usually from the sale of goods and services to customers — is the “economic engine” of any company. The current economic downturn will have at least two impacts on revenue and the receipt of cash-flows:

- New sales will be difficult to come by; and

- Existing customers will delay paying invoices.

As some predictive models are indicating, there will be financial impacts for the next 12 months. Understanding the outcomes of one or both of the above factors is critical.

As the COVID-19 pandemic continues to alter business as usual, organizations are considering alternative or non-traditional ways to maintain, and even temporarily or permanently replace, revenue streams to stay afloat.

If your organization already has assets used in the production of a good, consider using those assets differently to generate alternative revenue sources — such as the multitude of manufacturers that have begun producing personal protective equipment as an alternative line of business. This potential solution would reduce some of your top line pressures while not having to reduce your cost lines significantly. Further information behind this retooling tactic can be found in “Manufacturing Companies Pivot to Produce PPE, Medical Devise for COVID-19 Fight [Updated]” published by Manufacturing Automation.

Other examples of creative ways organizations are altering their operations to obtain additional revenue include restaurants shifting to takeout and delivery, gyms offering livestream videos of their classes, and potentially sport leagues playing their respected games and matches without spectators.

Regarding the delay in receiving payment for delivered goods or provided services, send invoices out promptly and monitor accounts receivable aging. Approaches to maintaining the continuous flow of payments include offering an early payment discount or offering a discount for committing to a full year’s worth of goods or services.

Outside of offering discounts to customers, this may be the time to revamp your customer base. Start by identifying your top 20%, middle 60% and bottom 20% customers. This will provide perspective into which customers can commit to future revenue streams, which can continue to pay on time, which are asking for discounts and concessions, etc. This is the time to create a strategy around which customers help (or hurt) your organization’s financial objectives. Although this crisis is hurting a majority of businesses, it also presents a unique (albeit challenging) opportunity to prioritize your customer base.

Gross Profit

Gross profit is the profit an organization makes after deducting its cost of goods sold (COGS). COGS includes all of the direct expenses related to producing a good or service, such as direct labor, material and shipping. This figure represents profit before overhead expenses, interest payments and taxes. At its heart, gross profit indicates the efficiency of the management in using labor and materials in the production process and varies by industry.

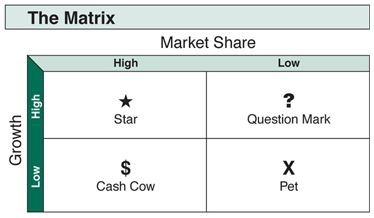

With the current economic conditions, you may now have the need to become more strategic about this piece of the income statement. For instance, consider the Boston Consulting Group’s product portfolio matrix. According to the article The Product Portfolio, “To be successful, a company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows. High growth products require cash inputs to grow. Low growth products should generate excess cash. Both kinds are needed simultaneously.” Meanwhile, companies should divest from products that are neither growing nor producing strong profitability.

The below matrix demonstrates the different terms used to represent a product growth compared to its market share:

Source: The Product Portfolio

The idea of this matrix is to first invest in an idea or product. Once the product hits the market, the product either becomes a “star” with high growth and high market share, or a “question mark” with high growth and low market share. A star will nearly always show reported profits. If the product remains a leader, it will become a large cash generator, even when growth slows, essentially developing into a cash cow. A “question mark” will require added cash investment to gain market share. The combination of low market share and high growth product is considered a liability unless it is fortunate enough to become a leader. If a question mark is unable to increase its market share, it will convert to a “pet,” which will require all profits to be reinvested to maintain its position in the market.

Using the matrix to complete a product segmentation during a financial crisis can be a good way to eliminate lower margin products, such as a pet, and reinvest in more profitable lines of business, such as a star.

Net Income

Last but not least, net income is considered the bottom line on the income statement and represents an organization’s net profit after accounting for all revenue, expenses, gains, losses, taxes and other obligations.

The jury is out on how long this pandemic will last, so it is crucial to be prepared for all scenarios, whether that is three, nine or even 18 months of slow or declining revenue growth. In the case of a three-month pandemic, methods to help reduce costs include halting variable overhead like hiring, marketing and travel. As the potential length of the pandemic increases, so do the measures management must take to continue treading the pandemic waters.

In the case of nine months to a year, management will have to rearrange the organization’s business strategy to further reduce variable expenses, renegotiate fixed expenses, such as rent, salaries, lease payments, etc. and focus on methods to survive. This is the time to become creative in ways to bring your product or service to market.

At 18 months or beyond, companies may need to reexamine sales revenue goals, product timelines, operating plans and go-to-market strategies. During this time, it would be imperative for the organization to maintain lines of communication and continue complete transparency with all stakeholders.

The image below demonstrates the different revenue metrics as an organization analyzes net revenue, gross profit and net income. A few assumptions can be made from the PowerBI Liquidity Dashboard image below. For instance, net losses in earlier periods take into account non-cash items, such as depreciation, and can generate a tax benefit. On the other hand, profitability (profit margin) was highest in the earlier periods, even though there is a net gain in the last period.

We hope our “Business Intel” series has provided ways to strategize and supplement nimble decision making as you continue to maneuver through this disconnected market and find the best ways to navigate your liquidity metrics and strategic revenue plan.

Contact John Cavalier or a member of your service team to discuss this topic further.

Cohen & Co is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law with your professional advisers.