Interval and tender offer funds — new kids on the block? Not quite. Believe it or not, interval funds have been around since Michael Jordan and the Chicago Bulls delivered their first three-peat of NBA Championships. That was a little over three decades ago! Tender offer funds, on the other hand, matured during the 1980s, right around when Jordan’s NCAA career catapulted.

Based on recent public filings, total net assets of active interval and tender offer funds have also gained popularity and reached all-time highs. As of September 30, 2024, research shows 235 active interval and tender offer funds with a total of approximately $160 billion in net assets. According to Morningstar, interval fund assets under management alone have grown almost 40% per year to $80 billion over the past 10 years, through May 2024.

So, what are interval and tender offer funds? Who can invest in them, and what are some of the benefits and regulatory considerations investors, fund managers and boards should consider as more of these funds continue to launch and convert from private funds? Keep reading to find out.

1. What Are Interval and Tender Offer Funds?

Interval and tender offer funds are similar to private equity funds but in a registered fund wrapper. Under the Investment Company Act of 1940, registered funds also include open-ended mutual funds, exchange-traded funds (ETFs) and listed closed-end funds. However, unlike mutual funds or ETFs, you cannot exit or trade your position daily with interval or tender offer funds. The illiquid nature of closed-end interval and tender-offer funds is akin to a traditional private equity fund, although not identical. The closed-end feature is a misnomer, because these registered funds offer some liquidity throughout the year. While interval funds have set quarterly redemption periods as part of a fundamental policy (through quarterly repurchase offers between 5% and 25% of the fund’s outstanding shares), tender offer fund redemptions are determined at the fund board’s discretion. These funds essentially buy back shares directly from shareholders in limited quantity. This feature may limit a shareholder’s ability to liquidate their investment.

Given the limited liquidity, fund managers can invest in more esoteric asset classes — such as private credit, real estate and private companies — or even invest in other investment companies — such as hedge, private equity or venture capital funds. While private credit (taking advantage of the current interest rate environment) dominates the active interval fund market today, sitting at over 62%, real estate is up and coming at nearly 20%. This is what makes interval and tender offer funds unique; they provide public access to alternative investment strategies. Under the ‘40 Act, an open-ended mutual fund cannot hold more than 15% of its total assets in illiquid investments. Interval and tender offer funds have no limits on illiquid investments, other than being able to maintain sufficient liquidity requirements to fulfill repurchase requests.

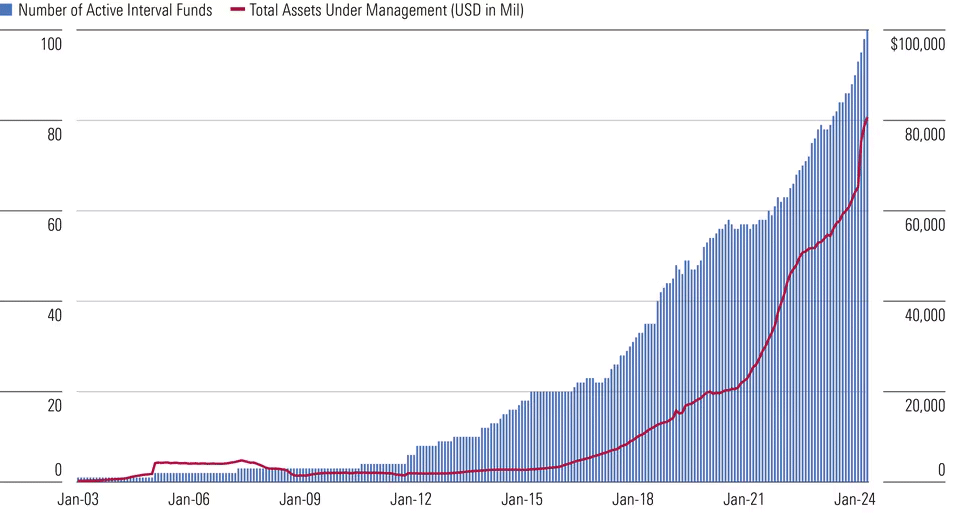

Growth of Interval Funds

The growth of the interval fund market in terms of both assets under management and number of funds from January 2003 through May 2024.

Source: Morningstar Direct, fund company filings. Data as of May 31, 2024, or most recent holding disclosure.

2. Who Can Invest in Interval and Tender Offer Funds?

The beauty of interval and tender offer funds is that nearly anyone can invest in them (with relatively low minimums, typically ranging from $10,000 to $25,000). Unlike a hedge or private equity fund, which have specific net worth (i.e. $1 million or $5 million) and accredited and qualified investor requirements, the everyday investor can put their money into interval and tender offer funds, serving as a conduit for retail and institutional investors alike. There are certain exceptions. If an underlying fund investment is only available to accredited investors, or if the fund has a performance fee, then the fund is available only to accredited investors.

3. What are the Benefits of Interval and Tender Offer Funds for Investors and Fund Managers?

There are substantial benefits for both investors and fund managers of closed-end interval and tender offer funds to consider, including:

- Investors

- Retail access to institutional-grade alternative investment strategies, such as private credit, commercial real estate, consumer loans, private companies and other illiquid assets

- Better transparency and liquidity than investing in a private fund

- Higher return potential for investors compared to open-ended mutual funds and ETFs

- Lower minimum investment amounts compared to private fund counterparts

- Typically, less market-reactive and volatile since investments are not tied to equities, potentially providing more protection and stability to investors

- May help promote a long-term investor mindset (for those investors who do not need immediate access to their capital) given illiquid underlying fund portfolios that may take years to bear fruit

- Fund Managers

- Better access to capital, particularly through retail investors, to fund investment strategies and growth

- Ability to charge higher management fees than open-ended funds, given esoteric portfolios

- Can charge performance fees like a hedge fund or private equity fund, although these fees are restricted to funds that only have qualified clients — defined in the Advisers Act as natural persons or companies with at least $1 million in assets under management with the adviser or who have a net worth of at least $2 million

- Can charge fulcrum fees, i.e., fees that go up or down depending on fund performance, for all funds, including those offered to retail investors

- According to Morningstar, the current average prospectus adjusted expense ratio across all interval fund share classes is 2.49%, versus 0.58% and 0.99% for ETFs and mutual funds, respectively

4. What are the Regulatory Considerations and Challenges of Interval and Tender Offer Funds?

If you are a fund manager or audit committee member, there are many audit, tax and regulatory considerations and challenges to think through, including the following:

- From a registration standpoint, you must file Form N-2, versus Form N-1A (for open-ended funds) with the U.S. SEC, along with several other forms throughout the year.

- When launching an interval or tender offer fund, you must obtain a seed audit of the fund’s initial financial statements from an independent registered public accounting firm.

- There are quarterly reporting requirements to the SEC via Form N-PORT, and semi-annual and annual reporting requirements via N-CSR forms. The newly implemented tailored shareholder reporting for mutual funds under Form TSR are not applicable to closed-end funds.

- Annual audited financial statements must be mailed to fund shareholders within 60 days of the period end and filed with the SEC within 10 days of mailing to shareholders.

- If you plan to have multiple share classes within the fund, you must request exemptive relief from the SEC.

- Given the nature of these funds’ underlying investments, your valuation policies need to be detailed and aligned with acceptable valuation methodologies following U.S. GAAP, i.e., market approach, income approach, practical expedient, etc., as often as NAVs are determined.

- During an audit, there would be deep dive requests around valuation due diligence, techniques and significant valuation inputs used, including for example, EBITDA multiples, market comparables, discounted cash flow assumptions, etc. This may include requesting audited and unaudited underlying financial information from counterparties.

- For investments in other investment companies, such as fund-of-funds structures, where net asset value is used as a practical expedient for valuation purposes, confirmations of these positions with underlying fund managers and administrators are required. Reviews of investee fund capital statements and underlying audited financial statements, and an assessment of investee fund performance from the audited financial statement date to the interval or tender offer fund’s reporting date are also required.

- From a tax perspective, you must actively monitor income from underlying private investments and manage the diversification of the portfolio to meet strict regulated investment company (RIC) qualification compliance requirements.

5. What are Some of the Considerations When Converting a Private Fund to an Interval or Tender Offer Fund?

If you are a fund manager considering converting an existing private fund to an interval or tender offer fund, so you can use the track record and performance history of the private fund, you:

- Must be a registered investment advisor (RIA) with the SEC.

- Must have private fund shareholder approval to convert the fund to a registered fund product.

- Will typically work with your fund counsel and SEC reviewer to convert the fund to a registered fund.

- It is important for your fund counsel to be fluent in the ‘40 Act to navigate regulatory hurdles and typical milestones with these registered funds.

- Must ensure your Form N-2 filing includes recent audited and/or unaudited financial statements of the private fund.

- Must maintain varying levels of fidelity bond coverage based on fund assets to satisfy the ‘40 Act.

- Should be aware that while private fund audits fall under AICPA standards, registered funds, including interval and tender offer funds, must abide by more stringent PCAOB standards and have SEC Regulation S-X requirements. This will ultimately not only result in higher audit and tax fees, but will also add to additional time and effort from your staff, such as:

- Needing to invest in stronger internal operations and find qualified treasurers and CFOs with relevant experience.

- Requiring a more active approach to be engaged with service providers and sub-advisers, if applicable.

- Needing more disclosures, from a financial statement presentation perspective. This could include disclosing a complete Schedule of Investments, versus a Condensed Schedule of Investments as accepted under AICPA standards. There would also be additional footnote disclosure requirements to comply with SEC Regulation S-X.

- Will typically have fiscal year-end dates throughout the year, e.g., 3/31, 4/30, 6/30, etc., with interval and tender-offer funds depending on the nature of the underlying investments and manager preference. The choice of year-end may align with when valuation of investments can be effectively completed and relevant financial information, such as audited financial statements, are available.

- If elect to be treated as a RIC for tax purposes (generally most interval and tender offer funds do), must comply with strict tax requirements, including but not limited to:

- Organizational requirements (domestic corporation, registration under the ‘40 Act, RIC tax election)

- 90% qualifying gross income for the year. This includes from underlying investments, as discussed above, particularly important for interval and tender offer funds with esoteric investments and investments in other funds.

- 50% and 25% quarterly asset diversification tests and look-through requirements

- 90% annual distribution of investment company taxable income and exempt interest income to shareholders.

- Consideration of tax-free reorganization/assets contributed in-kind.

- Election of tax cost-basis that’s carried over post conversion.

- Filing of Form 1120-RIC: U.S. Income Tax Return for Regulated Investment Companies and Form 8613: Return of Excise Tax on Undistributed Income of Regulated Investment Companies

- May need to consider additional regulatory compliance areas, including compliance formalities, organizational and recurring board and audit committee meetings.

- May need to consider other tax compliance needs if elect to be treated as a real estate investment trust (REIT) or partnership for tax purposes.

- Must be prepared to provide potential investors a clear explanation of fund strategy, risks, redemption requirements and additional information to educate them about the closed-end fund, benefits, risks and differences from other fund products.

While closed-end interval and tender offer funds offer a great opportunity for the everyday investor to gain exposure to alternative investments, including offering diversification and potentially higher yielding investments, they do not come without risk. From a regulatory perspective, these funds pose challenges for audit and tax professionals and warrant additional considerations from fund managers and boards — and will continue to do so as the regulatory landscape evolves. It is critically important to work closely with advisers who specialize in this area of fund taxation and audits if you are considering launching a new interval or tender offer fund, or converting an existing private fund.

Considering launching a new interval or tender offer fund? Submit our interval fund inquiry form to tell us more about it to see how we can help.

Contact Syed Farooq or a member of your service team to discuss this topic further.

Cohen & Co is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law with your professional advisers.