Undoubtedly, businesses have experienced a plethora of major disruptions over the past few years, including accelerated labor market challenges. The shortage of skilled workers coupled with ongoing inflation is forcing employers to do more with less.

One way to combat the problem is to upskill employees you already have. Ohio’s TechCred program can offer eligible employers funding to do just that. Recognizing that businesses across all industries regularly make sizeable investments in technology, the Buckeye state offers the TechCred program to help employers stay competitive and support the upskilling initiative. Since its launch in 2019, the program has helped numerous industries and has recently announced new application windows for its 2024 program. The first of six windows in 2024 ends Jan. 31.

What Is the Ohio TechCred Program?

Ohio’s TechCred program offers credential reimbursement to eligible Ohio employers aiming to develop, train or upskill current or future employees via technology related, industry recognized certifications and credentials. The program reimburses employers up to $2,000 per credential earned and allows for up to $30,000 per employer, per funding round. If you are a registered business in Ohio and employ Ohio resident W-2 employees, your company is eligible for the program.

While the financial incentive of the program is clear, it also could help employers add a tool to their hiring and retention toolbox — incentivizing new hires with “paid” opportunities to advance their careers and maximizing the skills of current employees. Additionally, TechCred can be combined with other federal and state funding opportunities to cover costs that go beyond the TechCred limitations.

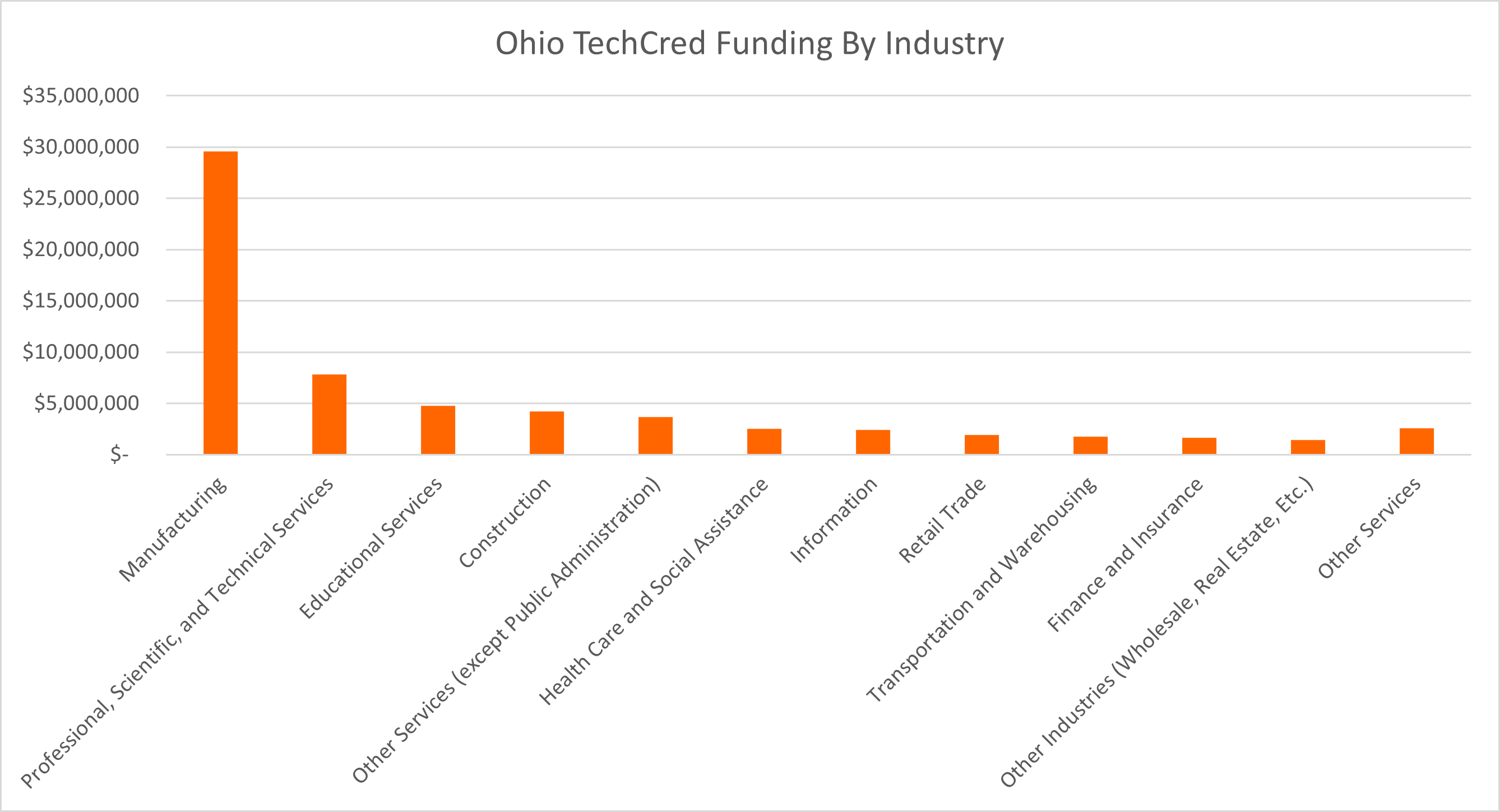

Since the program began, Ohio has awarded over $64 million across various industries, which ultimately supported workers across the Buckeye state earning over 57,000 industry recognized credentials (per data from the program’s website). The manufacturing industry has proven to be the largest sector taking advantage of the program to date. Below gives an industry comparison based on data from the data.ohio.gov website:

How Does TechCred Work?

After determining which new credentials will be most beneficial to the business, the employer must partner with an eligible provider, such as a university or tech school, that offers the appropriate training. Once a provider is selected, the employer is ready to apply for the TechCred program at the Ohio.gov website.

Note that to apply for the credit, the employer does not need to name specific employees for the training, only the number of employees that will be earning the credential, as well as the average wage of such an employee before and after the credential is earned. If the application is approved, the employer then enrolls employees in their respective programs.

To be reimbursed, employers must submit documentation that the employee has completed the course/training, its cost and the employee’s information within six weeks of completion.

Who is Eligible?

Employers seeking to use TechCred are not limited by their size or industry. All Ohio registered employers that employ Ohio resident W-2 employees are eligible for the program.

For employees to qualify, an individual must earn W-2 wages and be an Ohio resident at the time reimbursement is requested.

What Credentials Qualify?

Eligible credentials and certifications must be industry-recognized and technology-focused. These credentials can be earned online or in person through universities, community colleges, technical centers or private training providers. In addition, the credentials must be completed in less than 12 months and less than 30 credit hours or 900 clock hours.

What Are the Ohio TechCred 2023 Application Windows?

Throughout 2024, there are a handful of application windows to apply for the program:

- Jan. 2-31, 2024

- March 1-29, 2024

- May 1-31, 2024

- July 1-31, 2024

- Sept. 2-30, 2024

- Nov. 1-29, 2024

The Ohio TechCred Program has the potential to help your business retrain employees with the skill sets you need. If you haven’t considered taking advantage of this program yet, it may be worth considering as you plan for your company’s 2024 needs.

Contact Marc Mazzella or a member of your service team to discuss this topic further.

Cohen & Co is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.