In our recent post on M&A integration strategies, we defined two approaches for a potential M&A integration: building a holding company versus fully integrating an acquisition. Now we will examine how an acquisition can be a catalyst to reimagine your organizational design and create enterprise value by connecting often disparate business functions. This process provides the opportunity for organizations to think about the newly acquired capabilities and how those capabilities add, complement or duplicate existing organizational capabilities. Ultimately, a redesign of the company’s operating model can be a lever to unlock additional deal value by increasing product/service value and eliminating unnecessary operating costs.

First, Plan for Organizational Change

There is a delicate balance between maintaining the status quo and tackling transformational initiatives to gain a competitive edge. The burning question is how can organizations going through a merger or acquisition extend organizational capabilities, realize cost savings and ensure cultural change all while limiting disruption to the business? Adding to the challenge is that there isn’t a more sensitive aspect of an integration than planning for and executing an organizational model transformation. Even leaders from the acquiring business are faced with the WIIFM, “what’s in it for me?”

This makes a thoughtful plan to operating model design even more critical heading into a transaction. In the current fast-paced, increasingly autonomous business environment, it is important to keep in mind and apply Michael Arena’s concept of “adaptive spaces.” Organizations must operate at an agile pace in which, according to Arena, “creativity, innovation, and novel ideas flow freely among teams, across departments, and throughout the company.” This is a shift from deploying a hierarchical operating model that is focused on continuous improvement and cost cutting.

- In thinking about the future operating model design, focus on the principles that drive performance:

- Developing thoughtful goals to align the organization,

- Empowering cross-functional teams,

- Standardizing processes and tools, and ultimately

- Improving execution through an increased sense of accountability.

Most of these are covered by components of a typical M&A deal — except for how to restructure your operating model and organizational chart. This is where we need to dive deeper.

When and How to Create Organizational Change

Every transaction should have a value-creation thesis, but companies typically lack an established process to identify synergies and track progress of realizing their targets. We recommend building these steps into the traditional M&A transaction process to enable a practical approach to developing the future operating model design.

Letter of Intent: Initial value-creation thesis captures high-level synergy targets and integration strategy.

Due Diligence & Integration Planning: Set aside time to not only focus on historical financial performance and operating risks (due diligence), but also to talk with the seller’s management team to deepen your understanding of key business leaders, roles and business capabilities.

Develop a “strawmodel” of the future-state operating model. Move beyond who in the seller’s organization fits into your existing business to rethink these operating model components entirely. This includes evaluating:

- Organizational design and reporting structure

- Committee structure and charters

- Board oversight and responsibilities

- Management accountability practices

- Performance management and incentives

- Operating principles

- Talent development programs

Day 1: In coordination with the integration management office (IMO), schedule functional discovery meetings with department leaders from the acquired business. Develop a template to capture consistent information across the business in areas such as process variants and integration considerations. You’ll also want to critically evaluate your talent (manager vs. individual contributor, business critical role, duplicative role, role candidate for automation and talent score).

0-100+ Days: Conduct functional discovery meetings and consolidate the information in the IMO. Revisit the strawmodel operating model and adjust based on new information.

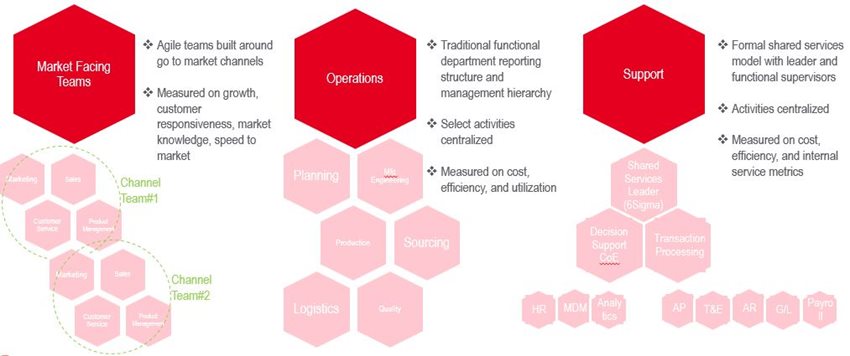

For the organizational design and reporting structure, think outside of the traditional hierarchy box:

- Build market facing teams, focused on growth, customer responsiveness, market knowledge and speed to market

- Structure operational functions into traditional hierarchy with clear measures of success on cost, efficiency and utilization

- Optimize support functions into a shared services model with a six sigma mindset to continuously drive quality improvement and cost reduction

Within 100 days post-close, you can have a new operating model that leverages your greatest assets in their highest value position, while simultaneously driving cost reduction. This is the goal of any business leader, but they often struggle to implement such change around business-as-usual events. That’s why your M&A transaction can be the perfect catalyst to get a new and better operating model in place.

The culmination of a successful organizational redesign should create a more agile, proactive workspace complemented with the use of technology to yield better quantitative and qualitative results. Recall that operating model design encompasses much more than simply the structure; it is the process of aligning an organization’s structure with its mission.

Contact John Cavalier at jcavalier@cohenco.com or a member of your service team for further discussion.

Cohen & Co is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.